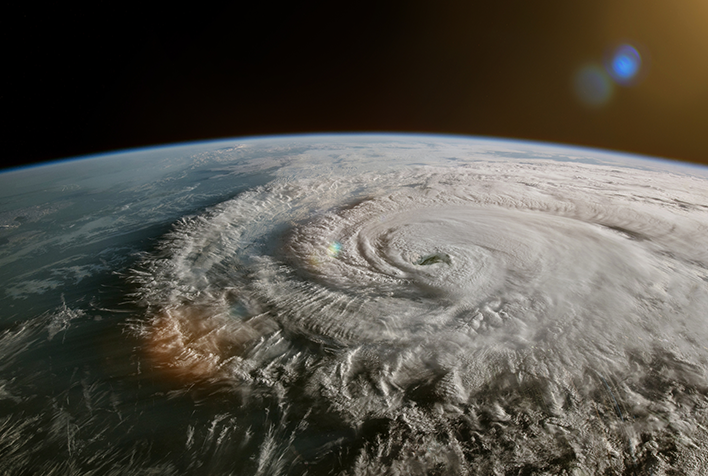

Rita, Ike, Katrina, Harvey, Imelda and countless others. Throughout the years, we’ve all grown to know the names of some of the most devastating hurricanes and storms to hit the Gulf Coast. Hurricane season is fast approaching on June 1 and, for small business owners, failure to plan ahead can be a costly mistake.

According to the Federal Emergency Management Agency and the U.S. Department of Labor, about 40% of small businesses do not reopen after natural disaster strikes. More than 25% of those businesses without a continuity plan in place will fail within the next year.

So, the question then becomes, “How do I keep my small business safe through natural disasters?”

The most obvious answer is to board up all windows and doors, place sandbags around the perimeter of your building, keep a close eye on weather conditions and hope for the best. Though, for small business owners, it’ll take more than just a traditional hunker down to protect their businesses. Learn how you can keep your small business financially safe before disaster strikes with these essential hurricane preparedness tips.

Communication

It’s important to communicate as early and as fast as possible. In the digital age, social media is a powerful communication tool that connects business owners with their current and potential customer base. In the event of inclement weather or an approaching storm, utilize social media to keep your customers informed regarding hours of operation and alternative service options.

Remaining in constant communication with your employees and team is also critical. Develop a crisis communication plan that outlines each employee’s contact information and emergency contacts.

Secure Your Site and Keep Critical Information Safe

When a storm or hurricane is heading your way, the last thing you want to do is wait until the last minute to protect your assets. In case of a flood, move all furniture, equipment and documents away from windows and lower levels. Back-up all electronic files and store them in a safe place. Cloud storage or digital vaulting eases the burden of having to keep up with physical documents and adds an extra level of security to your business.

Build a basic emergency kit with essentials like flashlights, batteries, a first-aid kit, portable chargers, water and non-perishables to last a few days. Ensure that you have a back-up power source to keep all critical security assets working including cameras, fire and burglar alarms.

Is Your Business Adaptable?

Even if there is no physical damage to your business property, natural disasters can have a catastrophic effect on the local economy for days or even weeks at a time. If there is a power outage or a road blockage, will your business be viable enough to continue serving customers? If there is damage to the property, could your business stay afloat while waiting for building repairs?

Develop a back-up plan that allows your company the ability to quickly move to a remote presence, if needed.

Expect the Unexpected and Save For It

Unlike the weather, we can’t always predict what the future holds so, as the old saying goes, always expect the unexpected. Set up an emergency savings fund specifically for unexpected, emergency expenses. Whether you’re covering a large expense or small, if your business has been impacted by a natural disaster, emergency funds make it possible for you to recover quickly and get back to business as usual.

We’ve developed 6 Steps to Create a Budget for Your Small Business to help small business owners weather the storm against any unexpected circumstance. You can also contact a Stellar Banker at 713.499.1800 or [email protected] to set up the right savings account for you and your financial needs.

Always Stay Informed

While it may be tempting to keep operations normal, hurricanes and storms can be unpredictable and dangerous. Continue to monitor the weather and stay alert and listen to local officials for safety precautions. Use trusted resources for the latest updates like: National Weather Service, Harris County Flood Control District, and ReadyHarris.

Check the weather forecast regularly for updates:

Utilize Resources

The Small Business Development Center offers several programs to help small businesses recover from natural disasters and calamities. The Small Business Administration also offers low-interest disaster recovery loans for assistance with damaged and destroyed assets.

Below are links to available resources for additional information for hurricane preparedness:

Through uncertain times, Stellar Bank is here with you every step of the way to ensure that your business stays safe. Visit www.stellar.bank to explore financial resources and industry insights to keep your business in the know.